ACSI: Customer Satisfaction Steady for Full-Service Restaurants; Fast Food Declines as Consumers With More Purchasing Power Prefer Quality Over Price

ACSI: Customer Satisfaction Steady for Full-Service Restaurants; Fast Food Declines as Consumers With More Purchasing Power Prefer Quality Over Price

Texas Roadhouse, Chick-fil-A Debut on Top; McDonald’s Drops Again;

Strong ACSI Entry by Chipotle and Panera

ANN ARBOR, Mich., (June 30, 2015) – Customers are less satisfied with fast food as their discretionary income improves and preferences shift in favor of quality over price, according to new data from the American Customer Satisfaction Index (ACSI). Customer satisfaction with full-service restaurants holds steady at 82 on ACSI’s 100-point scale, while fast food restaurants fall 3.8 percent to 77, the lowest score in five years. The gap between fast food and full-service restaurants is the largest since 2010.

“The job market is the strongest it has been in years, which is having an interesting effect on supply and demand,” says Claes Fornell, ACSI Chairman and founder. “On the demand side, consumers with greater discretionary income seem to put quality ahead of price in their decision-making. On the supply side, restaurants are finding it harder to hire and retain qualified and motivated workers, which can have an adverse impact on service quality.”

The ACSI report, which is based on 5,023 customer surveys collected in the first quarter of 2015, is available for free download at www.theacsi.org/news-and-resources/customer-satisfaction-reports/reports-2015/acsi-restaurant-report-2015.

Two new entrants to ACSI debut at the top of limited-service (fast food) restaurants: Chick-fil-A and Chipotle Mexican Grill. Chick-fil-A leads at 86—the highest company score to date in the category. Fast casual restaurants, which typically offer better ingredients, freshness and more developed décor, make a strong showing as Chipotle takes second place in its first ACSI appearance with a score of 83.

The aggregate of small fast food restaurants, while still near the top of the industry, falls 4 percent to 81 and is a major drag on the industry’s overall ACSI score. Panera Bread rounds out the top three companies with a first-time score of 80.

“The fast casual segment of quick service restaurants is nicely situated for the confluence of changing consumer tastes and a rebounding economy,” says ACSI Director David VanAmburg. “Consumers have a bit more money in their pockets, but are still pressed for time. Fast casual outlets offer higher-quality ingredients, freshness and fast service – all at a reasonable price.”

Pizza chains suffer from changing consumer preferences. The four major pizza purveyors in the study endure large customer satisfaction losses. Papa John’s and Yum! Brands’ Pizza Hut each shed 5 percent to 78, while Domino’s falls 6 percent to 75. Little Caesar loses the most, diving 8 percent to 74. Over the past several years, pizza chains have increasingly competed on price, sometimes at the expense of quality ingredients, and that is now beginning to have a negative effect on customer satisfaction.

Established fast food entities like McDonald’s (-6% to 67), Burger King (-5% to 72), KFC (-1% to 73), Wendy’s (-6% to 73), Arby’s (debuts at 74) and Taco Bell (unchanged at 72) remain at the bottom of the industry. As the largest fast food company in the United States, McDonald’s weak customer satisfaction puts downward pressure on the overall industry score. Company revenue has dropped for six straight quarters. As the economy improves, McDonald’s needs higher levels of customer satisfaction if it is to reverse the revenue trend.

Dunkin’ Donuts is the only fast food chain to improve customer satisfaction in 2015. The company climbs 4 percent to 78, jumping ahead of Starbucks (-3% to 74). In 2014, Dunkin’ Donuts rolled out a beverage rewards program tied to its mobile app with seemingly positive results. The chain is extending its U.S. presence beyond its Northeast stronghold to the West, hoping to gain traction against not only premium outlets like Starbucks, but also McDonald’s, which offers quality coffee at lower prices.

In the full-service category, the aggregate of smaller chains scores 83 and shares the lead with ACSI newcomer Texas Roadhouse. Darden’s LongHorn Steakhouse debuts at 81, but Outback Steakhouse slides 3 percent to 78. Another new ACSI entrant, Cracker Barrel Old Country Store, scores 80, coming in just ahead of Darden’s Olive Garden (-1% to 79).

The competitive landscape once had full-service restaurants expanding their menus to broaden appeal, but the trend now is toward simplification and shorter menus. As of yet, however, these changes do not seem to have had much of an impact for companies like Red Lobster (-1% to 77) and Chili’s (unchanged at 74). Other full-service restaurants new to the Index are Red Robin Gourmet Burgers (77), TGI Fridays (76), Denny’s (75) and Ruby Tuesday (73).

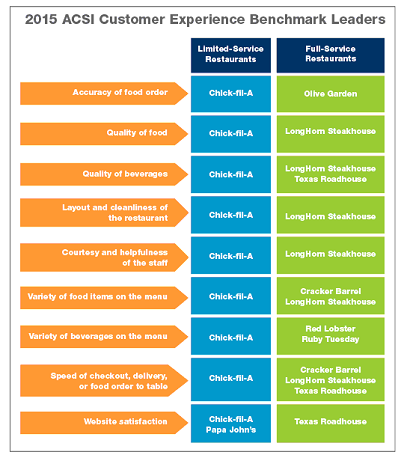

In addition to company and industry customer satisfaction scores, the ACSI measures critical elements of the dining experience that affect patron satisfaction. These customer experience benchmarks include the quality and variety of food and beverages, restaurant layout and cleanliness, and service elements such as staff courtesy, food order accuracy, and speed of food delivery to the customer.

The chart that follows shows the benchmark leaders in the fast food and sit-down dining segments. Across nine aspects of the fast food experience, Chick-fil-A leads the field. The company now surpasses KFC as the largest U.S. fast food chicken chain. Among full-service restaurants, LongHorn Steakhouse is a leader across most elements, including food quality, staff courtesy, and restaurant layout and cleanliness. The Darden-owned chain posted strong sales growth as of the fourth quarter of 2014.

The ACSI Restaurant Report 2015 provides industry-level benchmarks across both restaurant categories.

Follow the ACSI on Twitter at @theACSI and Like us on Facebook.

No advertising or other promotional use can be made of the data and information in this release without the express prior written consent of ACSI LLC.

About ACSI

The American Customer Satisfaction Index (ACSI) is a national economic indicator of customer evaluations of the quality of products and services available to household consumers in the United States. The ACSI uses data from interviews with roughly 70,000 customers annually as inputs to an econometric model for analyzing customer satisfaction with more than 300 companies in 43 industries and 10 economic sectors, including various services of federal and local government agencies.

ACSI results are released throughout the year, with all measures reported on a scale of 0 to 100. ACSI data have proven to be strongly related to a number of essential indicators of micro and macroeconomic performance. For example, firms with higher levels of customer satisfaction tend to have higher earnings and stock returns relative to competitors. Stock portfolios based on companies that show strong performance in ACSI deliver excess returns in up markets as well as down markets. At the macro level, customer satisfaction has been shown to be predictive of both consumer spending and GDP growth.

ACSI and its logo are Registered Marks of the University of Michigan, licensed worldwide exclusively to American Customer Satisfaction Index LLC with the right to sublicense.

ACSI: Customer Satisfaction Steady for Full-Service Restaurants; Fast Food Declines as Consumers With More Purchasing Power Prefer Quality Over Price

ACSI: Customer Satisfaction Steady for Full-Service Restaurants; Fast Food Declines as Consumers With More Purchasing Power Prefer Quality Over Price