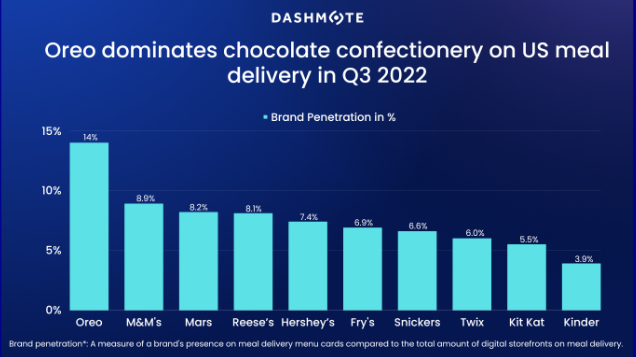

? We found that a staggering 1 out of 7 restaurants in the US lists an Oreo flavoured product on their menu on meal delivery.

Chocolate Snacks US: Insights from Food & Beverage Magazine

? The global chocolate market size was estimated at USD 113.16 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030. The United States is the leading world market for confectionery of any kind, with its cocoa and chocolate market estimated to be worth USD 19.4 billion. The growing demand for chocolate can be shown by the statistics that US consumers were eating, on average, 7 kilograms more during the first year of the pandemic compared to the previous year.

Read Also: Chinglish Chef Lam: Spotlighted in Food & Beverage Magazine

? By leveraging Dashmote’s Data Analytics SaaS platform, we analysed the chocolate confectionery category across major US meal delivery platforms in Q3 2022. These were the key takeaways:

- Oreo has the highest brand penetration rate in Q3, 2022, that 14% of Digital Storefronts (DSFs) on the US meal delivery platforms list an Oreo flavoured product. This is followed by M&M’s with an 8.9%, and Mars with an 8.2% penetration rate.

- Oreo controls 15% chocolate confectionery market share on US meal delivery, which is around 2 times more than Hershey’s (7.9%) and Fry’s (7.4%).This domination could be largely influenced by the partnership with McDonald’s for the McFlurry, as well as the variety of Oreo sub-category products, such as Oreo milkshake and Oreo cheesecake

- Mars Inc. dominates the chocolates category on meal delivery (35% manufacturer market share). They own strong brands such as M&Ms, Mars, Twix, Snickers and Milky Way. Mondelez (16% manufacturer market share) comes in 3rd just after Hersey’s (18% manufacturer market share).

- There were in total 214k DSFs on Grubhub listing chocolate confectionery products, which was less than half of the 420k DSFs on DoorDash, and 548k DSFs on Uber Eats in Q3 2022. This could cause restaurants on Grubhub to generate fewer sales from snacks than their peers on other delivery platforms.

? What’s your favourite cheat day snack? Find the link to the full article ‘?????? ?? ??????: ?? ???????? ?? ??? ????????? ????????????? ?????? ?? ?? ???? ????????’ in the comment section.

#oreo #mealdelivery #datainsights #chocolate #foodandbeverage