To anyone in the F&B industry on the glide path to retirement, it is becoming clear that today’s retirees are facing a completely different set of challenges than prior generations. This is the first generation in which retirees are carrying mortgages and other debt into retirement.

And the hospitality industry has its own set of challenges. According to a PEW report, a mere 34 percent of companies in the leisure and hospitality industry offer retirement plans, with a paltry 23 percent of those with access to such plans actually participating. Other reports cite problems for boomers in the hospitality industry who had their retirement plans put on hold due to the recession, in that these folks are looking for ongoing work even in physically demanding roles that they may not be equipped to fulfill.

Adding to the complexity, health care costs are expected to eat an ever increasing piece of the retirement budget. As well, an increasing number of those entering retirement are sandwiched between the needs of their financially-troubled adult children and their aging parents.

In view of the increasing costs of retirement, the traditional notion that retirees will only need 70 percent of their working income could very well be a dangerously misguided assumption.

Below are some salient retirement finance insights from Ray LeVitre, CFP, author of “20 Retirement Decisions You Need to Make Right Now” and Founder/Managing Partner at Net Worth Advisory Group. This 19+ year industry veteran helps individuals make key financial decisions during that critical yet oft underestimated period transitioning from the workforce into retirement—many of which are irrevocable and profoundly affect one’s financial security and lifestyle for decades beyond.

Add in Longevity Risk

Compounding these challenges is longevity risk, which wasn’t much of a concern for prior generations. While most people may understand they can expect to live longer, few realize that life expectancy is constantly expanding, meaning that the older you get, the greater you can expect to live. Today, there is a one in four chance that one of the spouses of a 65-year old couple will celebrate their 95th birthday, and it is more than likely to be the wife. The greater risk is that few 65-year old people fully grasp the enormity of this risk.

The risk of longevity is further compounded by the risk of inflation. Even at an average inflation rate of 3%, the cost of living will double in 20 years which could put many retirees’ life style in jeopardy. Any resurgence of inflation to the levels seen in past decades could have a devastating impact on the lifetime income value of your assets.

Add in the Risk of Investing too Conservatively

For many people, the further they move down the retirement glide path, the greater the temptation to invest more conservatively, which is understandable. However, tilting your allocation towards conservative investments too quickly can expose your financial security to a much larger risk, which is the loss of your purchasing power at the time you really need it.

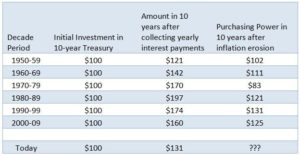

The chart below illustrates the erosion of purchasing power on earnings generated from an investment in 10-year Treasury Bonds. The decade of 2000 – 2009 had one of the lowest rates of inflation, as measured by the Consumer Price Index, in the last 30 years, yet purchasing power on the earned income was reduced by 25 percent. It is important to note that the CPI, which is the official government measure of inflation, doesn’t include food and gas prices which have increased at rate three times the CPI over the last couple of years. If food and gas prices were included in the CPI, the rate of inflation would be closer to 10 percent, and, at that rate, the net purchasing power of earnings in ten years would be less than the initial investment, meaning you would have lost money.

Investing your money in safe or guaranteed instruments may provide peace-of-mind that you won’t lose any money due to market fluctuations; however, each day that your returns fail to exceed the rate of inflation, you are, in effect, losing money, and that loss becomes more pronounced over time.

Conservative Investing is about Managing All Risks

There are ways to invest conservatively that can reduce portfolio volatility while addressing the risk of inflation. The key is in knowing what your financial objective is in real terms by factoring in the true cost-of-living and taxation. Once you know the real rate of return that must be achieved to provide lifetime income sufficiency, a diversified portfolio of equities and fixed-income securities can be constructed to match your particular risk profile With an investment strategy tailored to your specific needs and objectives, you need not take any more risk than is absolutely necessary to achieve your objective.

A well-conceived investment strategy focuses on managing the risk and volatility of your portfolio; your job is to stay focused on your objective.

Branding, business and entrepreneurship success pundit, Merilee Kern, MBA, is an influential media voice and lauded communications strategist. As the Executive Editor and Producer of “The Luxe List International News Syndicate,” she’s a revered consumer product trends expert and travel industry voice of authority who spotlights noteworthy marketplace change makers, movers and shakers. Merilee may be reached online at www.TheLuxeList.com. Follow her on Twitter here: http://twitter.com/LuxeListEditor and Facebook here: www.Facebook.com/TheLuxeList.

Sources:

- Infographic: National Association of Realtors, Economistsoutlookblog.realtor.org

- http://www.pewtrusts.org/~/media/assets/2016/01/retirement_savings_report_jan16.pdf

- https://www.efficienthire.com/3-big-challenges-facing-hospitality-industry-restaurants/