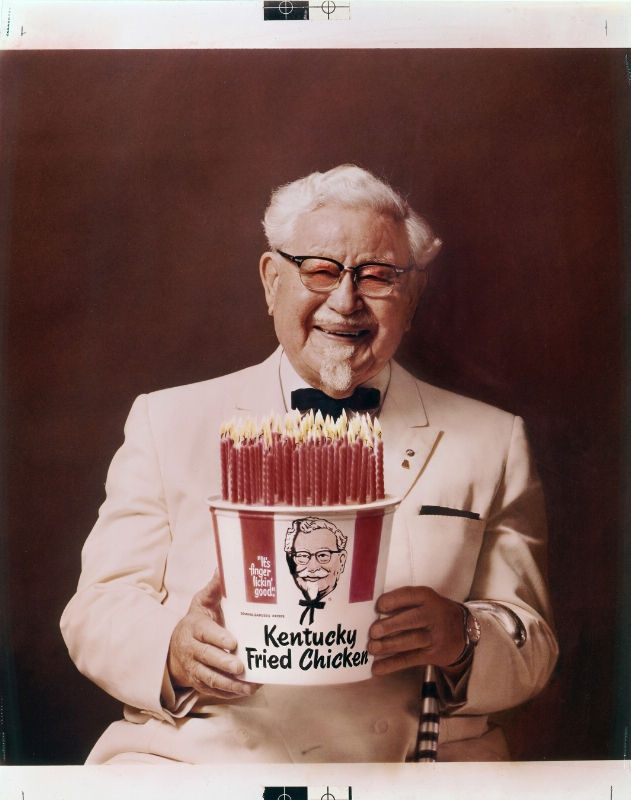

The food and beverage sector is among the most lucrative industries with virtually infinite longevity. As long as people continue to eat and visit new places, there will always be opportunities to carve a niche of your own within the food and beverage sector.

The food and beverage sector is among the most lucrative industries with virtually infinite longevity. As long as people continue to eat and visit new places, there will always be opportunities to carve a niche of your own within the food and beverage sector.

However, venturing into the food industry requires some groundwork and a feasible business plan.

A financial plan is a crucial aspect when pondering starting a business in this sector. Even after launch, you still need steady cash flow to optimize operations and meet business demands when they arise. One quick way to get your hands on cash is through unsecured business loans.

These loans are easy to qualify for and come with relatively low-interest rates, allowing you to sort various financial requirements without having to put down collateral. But what are unsecured loans, and how do they benefit your food and beverage business?

What are unsecured business loans?

As the name suggests, unsecured loans are loan products that do not require you to put down any security, such as collateral or deposit. They are short-term loans that lenders award based on their unique qualifications.

For example, a restaurant owner faced with increased demand for holiday desserts needed new oven installations but did not have the cash. His options included collateral-secured loans, personal loans, equipment financing, and unsecured loans.

Traditional banks also offered various business loans. However, these were mostly secured loans which require you to pledge a property, another account, inventory, or invoices. He eventually settled for unsecured loans from an online platform.

Within three months, the restaurant had repaid the loan and could now qualify for higher loan limits.

What are the benefits of unsecured business loans?

Besides, unsecured loans do not require any collateral, so if you are qualified, there is nothing you risk losing by taking an unsecured loan. The only downside is short repayment periods and slightly higher interest rates. Other than that, these loans are very efficient as they are offered by “alternative lenders” that use different criteria to qualify businesses for loans.

You can even get your cash within the same day. Most lenders that offer unsecured loans allow online pre-qualification and same-day loan disbursement. This is very convenient, especially if you have urgent cash requirements.

How can I get an unsecured business loan?

You can find unsecured loans from different online lenders and financial companies. Most lenders offer online loaning services, but you can still visit their main offices and branches. Some banks also offer unsecured loans. However, the process is much slower and involves a lot of paperwork.

Online lenders only require basic information and can quickly pre-approve you for higher loan limits with every on-time payment you make. You can start by looking for the best online platforms offering unsecured business loans in your locality. Another option is to ask your bank whether they have such a product.

Finding an unsecured business loan should not be a daunting task as several lenders are offering such products. However, it is essential to review your business needs carefully before applying for any loan. Unsecured loans are ideal if you do not have any collateral you are willing to give.

Qualifying for these loans may require a good personal credit score. Since the risk of default is higher, these loans attract a higher interest compared to secured loans.

Am I in the right kind of business to get an unsecured business loan?

They are perfect for any business, especially if you are strapped for cash. Like other short-term loans, they are better suited to the daily cash-flow transactions.

There are various ways you can use business loans if you are in the food and beverage industry. Unsecured loans still come with all the benefits of getting a business loan. This includes extra cash to manage business finances and facilitate different operations, whether marketing and advertising, salaries and wages, repairing cooking equipment, maintenance of the installations, an expansion to grow your café, or just to help your cash flow.

A loan could be sufficient to cover a month’s payroll or unveil new state-of-the-art equipment in your restaurant. It merely offers extra cash to invest in your business.

If you need money, then you are more likely to benefit from these types of business loans. Make sure you have a reliable repayment plan, especially if you take unsecured loans to start the F&B business.

Unsecured loans and the F&B industry ARE a good match

Having a business in such a profitable industry is a great idea. However, ensuring that your company grows and expands is the hard part.

Unsecured business loans can help you sort out various financial issues and keep the business running.

Nonetheless, not all lenders are the same. Make sure you compare current offers and pick loan products that suit your business. Since there is no single-fit for every business, it is essential to review your needs carefully.

How would you use a loan in your F&B business?